Building savings is still very popular in Germany. The main financial portals assume that 27 million building savings contracts are currently active, i.e. around three-quarters of German households. However, due to persistently low interest rates, the advantages of building savings, such as attractive interest rates or interest advantages on building loans, are no longer so profitable.

We at MARE Haus have already supported many builders with construction projects and construction financing and are in close contact with independent construction financiers. From these experiences we have collected for you the most important facts about building savings: below we will show you what it is and whether and for whom it is worth it in 2021.

Building savings: here’s how it works

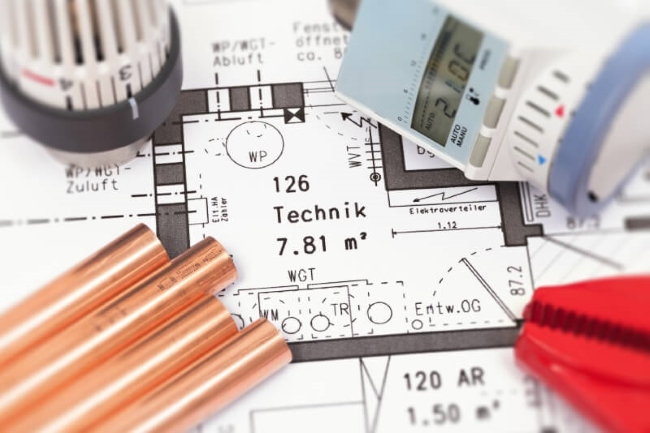

With a building savings contract you finance the construction, purchase or renovation of a property. Set an amount you want to invest in your property and start saving this amount in monthly installments. In most cases, the construction savings contract constitutes only one of the pillars of your construction financing and is linked to a subsequent construction loan. You will be able to take advantage of this loan when your construction savings contract is ready to be assigned. Normally, in order to access the loan it is necessary to save 30-50% of the amount of the construction savings.

Does building savings still offer advantages?

In the past, when interest rates were higher, there were attractive interest rates on money saved. The subsequent loan could instead be repaid at a fixed interest rate, usually lower than the general level of interest rates. This meant that you could secure attractive conditions.

With the decline in the reference interest rate, the interest rate on building savings contracts has also fallen dramatically in recent decades. In 2020 this percentage amounted to only 0.25% on average, which means that construction savings are no longer as profitable as a savings investment. Furthermore, the interest rates set for the building loan at the time of concluding the building savings contract are now much worse than those for a normal building loan.

For example, if you took out a building savings contract 20 years ago and the guaranteed interest rate on the loan was 3%, this interest rate is now well above the general level of interest rates. This means that in times of low interest rates it is often more profitable to take out a normal bank loan than to resort to a building society loan.

Construction savings guarantee low interest rates

It is therefore always important to keep an eye on the general trend of interest rates. Since interest rates are currently very low and no one knows how the situation will develop in the coming years, with a building savings contract you can secure these low interest rates in the long term. While the interest rate fixation on normal bank loans usually lasts 10 or 15 years, it may happen that a subsequent loan offers much less favorable conditions. With a building savings contract this cannot happen, as the interest rate is fixed for the entire duration, be it 25 or 30 years, until the last instalment.

Is it still worth saving when building in 2021?

In summary it can be said that the arguments against building savings prevail. On the one hand there are more profitable ways, such as ETFs or checking accounts, to save equity for a construction project. On the other hand, on the “free” market it is often possible to obtain better conditions for a building loan than those provided for in the building savings contract.

However, a building savings agreement can be a safeguard for the future. If interest rates rise again, you can secure today’s low interest rates for the long term. Since no one can predict how rates will develop in the future, a building savings contract concluded in 2021 represents a kind of safety net.

We also support you with construction financing

If you decide to build your house with MARE Haus, we will also help you with financing with our skills and contacts. We put you at the disposal of competent and independent construction financiers from our network, who will find the right financing concept for you and your living situation. Just ask us and create your home in Berlin, Brandenburg, Mecklenburg-Vorpommern with us – from Rostock to Berlin!

latest posts published

The basement as an ideal place for a home sauna

Building a condo is a breeze | What’s behind a condominium?

Splash protection for facades – that’s why it makes sense

How to design your home with a covered garage

Build savings in times of low interest rates

Useful information on property drainage | Considerations during construction

Interior wall plaster in brief

Heating with oil, gas or electricity

Foil as desired | Oknoplast