Even when you are thinking about building a house you should take into account the possible risks. First ask yourself the question: how safe your job is. It can happen at any time that they become unemployed or unable to work. Only people with a secure job, a stable income and a good credit rating have the ability to cover all potential liabilities with the money they earn. These are the basics that go beyond the loan amount decide.

Possibility of reimbursement for construction financing without equity capital

There are essentially 4 possible refund options:

The classic: annuity loan

Most borrowers choose this type of housing financing because… certain percentage of the loan year after year is deleted. In this case you pay a constant monthly instalment, consisting of a repayment portion and interest. In the complete financing contract you agree with your bank certain repayment rate and an interest rate. In most cases, this is an initial annual repayment of 1%, which can and should be increased in times of low interest rates. Subsequent financing is required at the end of the fixed interest period.

Loan with full repayment – for greater security

With a full repayment loan, you pay a constant monthly rate, Here the annual repayment installment is not specified, but the period in which you wish to pay off the residual debt towards the bank. This solution offers absolute interest rate security.

Final loan

You only need to do this during the term of the loan agreement the agreed and owed loan interest pay. Only at the end of the loan is repayment made, which is usually repaid through life insurance or building savings contracts.

Special refunds

With special refunds you have the possibility Repay your loan faster. Most annuity loans offer the option to pay larger contributions in addition to the current annuity repayment. The interest and repayment rate remain the same after a special repayment, with the repayment portion of the installment increasing at the speed of light.

Home financed at 100% or more

Previously, aspiring builders had to finance at least 20-30% of their construction project from their own resources. Taken today banks accept money for construction up to 100%, which also covers additional construction costs or additional purchase costs. However, this alternative is only an option for potential borrowers who have a very secure and very good income. However, there are also banks that first offer a construction savings contract and only then want to take charge of the construction financing. However, this has the disadvantage that it is not possible to take advantage of the currently low interest rates.

Requirements for a no-equity home loan

A no savings home loan is more expensive than a home equity loan because banks charge a higher interest rate. Since we currently have low interest rates, you should check your loan agreement to a long period of fixed interest consider. This is the only way to calculate the loan payment amount over a longer period of time. It is also important that the loan amount is as low as possible. Even if interest rates rise slightly, significant additional costs may arise and monthly payments may become unaffordable. It would also be recommended a well-thought-out budget. Banks will only approve your construction project if unplanned daily payment events occur, such as: B. car repairs would not be a financial bottleneck for you.

Interest reduction with a muscle mortgage – a good idea

If you, as a builder, can face a lot when building a house, it is worth asking the bank for one Interest discount for your work ask. You have the best chance if you work as a tradesman such as a roofer or an electrician in your daily life. This is a good starting point for banks and savings banks for further negotiations. In principle, if you contribute your own money, you get a better interest rate and can save some of the construction interest.

latest posts published

The basement as an ideal place for a home sauna

Building a condo is a breeze | What’s behind a condominium?

Splash protection for facades – that’s why it makes sense

How to design your home with a covered garage

Build savings in times of low interest rates

Useful information on property drainage | Considerations during construction

Interior wall plaster in brief

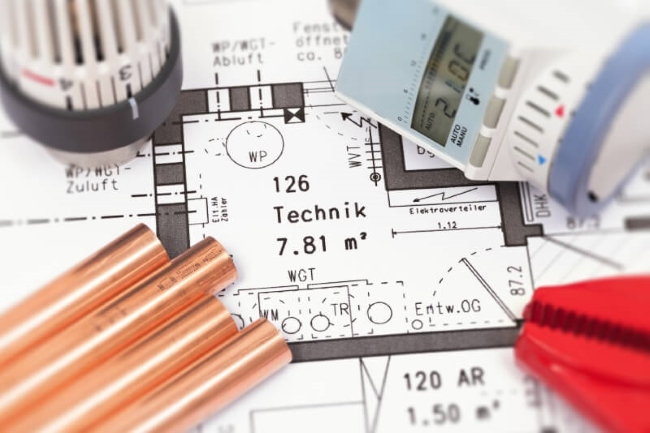

Heating with oil, gas or electricity

Foil as desired | Oknoplast