Finding the right property is the first step to owning your own home. However, until you purchase, there is a lot to consider: financing, location, development plan – just some of the many things you should keep tabs on when purchasing a property. In this article we have summarized for you the best advice for buying a property and the best way to proceed.

Criteria for purchasing a property

First of all it is better to get an overview and imagine the property of your dreams. This will help you identify important criteria that will make your search easier. What should be the location of your property: in the countryside or perhaps in the city? What are the transport connections like? How big should the future property be? These criteria help you as a buyer to quickly decide during viewings whether the property is suitable or not.

Calculate the costs

Once you have identified the criteria that your property must meet, the next step is fundamental: calculate the costs! You can only look for a suitable property if you understand how much money you have available. Don’t calculate too strictly here. But not in a way that threatens restrictions. Especially important: Don’t forget to think about other additional costs that may arise when purchasing:

- Development costs

- Notary fees

- Soil report

- Real estate transfer tax (may vary in individual federal states)

Find properties

Now the concrete search can begin – be prepared for the fact that it will take some time! It’s rare to find your dream property right away, but it’s worth being patient. Shop around online or locally, or hire a real estate agent to help you with your search.

A look at the development plan or location and land registry

You’ve chosen a property: congratulations! Now you should check some points. The more thorough you are, the smoother the subsequent construction will be. When we talk about “building a house” we are already in the right place: always check the development plan if and how construction is allowed on the property. Things like the number of floors, the shape of the roof and the maximum floor area of the house are often already specified.

If there is no development plan, section 34 of the Building Code usually applies. Fundamentally it is about ensuring that the planned building fits into the existing building stock.

If, for example, you plan to build a two-story townhouse with a hip roof and there are only one-story buildings with a gable roof in the area, it may be difficult to obtain a building permit.

The size of the development is also often related to the size of the property.

MARE expert advice: In this case it is advisable to carry out an environmental analysis. We will be happy to help you with this!

It is also advisable to consult the land register: here the walking, driving and management rights are recorded, which regulate access to the property. It also provides information on the ownership structure, which is essential for the sale.

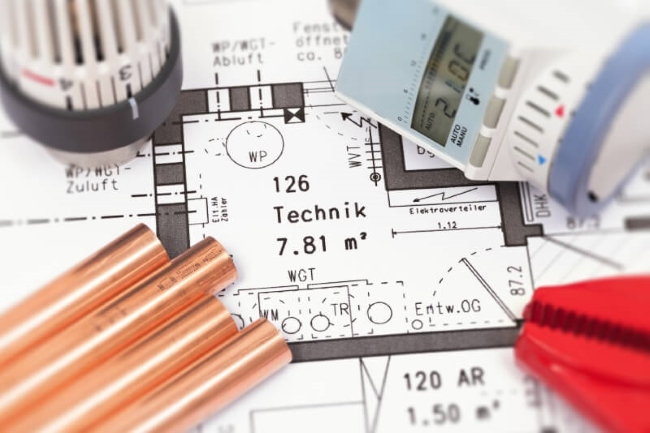

Check the development

You should also clarify the property development before purchasing so you don’t get stuck with unexpected costs. Are all the pipes you need installed in your home: electricity, water, sewer and internet? If not: Clarify with the seller who will bear the development costs. If these are yours, you will have to consider some additional costs when purchasing!

Soil conditions and load

Another important step is to check the soil.

MARE expert advice: Invest in a professional land report here!

If the soil is very boggy and does not have a certain load-bearing capacity, a pile foundation may be necessary. Construction sites and contaminated sites should also be checked. The nature of the terrain can also make construction projects difficult. So it’s not a bad idea to start thinking about building your driveway or a basement.

Construction financing

If all the requirements are met and nothing stands in the way of purchasing the property, it’s time to get financing. If you wish to obtain a construction loan from the bank, you should discuss in advance whether this is possible. Because there are also banks for which some building areas have no value and therefore the built properties do not offer any security for the bank. In that case it would be difficult to get a construction loan from this bank.

Notarial certification

The final step once financing is obtained is to complete the purchase. For this, a notarial certification is required. You acquired the property only after the notary certified your purchase and the entry in the land register changed to owner. You have now successfully mastered the first step to becoming a potential builder.

Our home building experts will be happy to support you every step of the way – call us or contact us using our contact form!

latest posts published

The basement as an ideal place for a home sauna

Building a condo is a breeze | What’s behind a condominium?

Splash protection for facades – that’s why it makes sense

How to design your home with a covered garage

Build savings in times of low interest rates

Useful information on property drainage | Considerations during construction

Interior wall plaster in brief

Heating with oil, gas or electricity

Foil as desired | Oknoplast